santa clara property tax appeal

Redwood City CA 94063. Street San Jose CA 95112.

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

California Property Tax An Overview CA State Board of Equalization Publication 30.

. Parcel Boundary Change Request. The process was simple and uncomplicated. County of Santa Clara Department of Tax and Collections 852 N 1st.

Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500000 property owners with convenient access to pay their secured property tax payments. Introduction The property taxes you pay are based on your propertys assessed value as determined by your County Assessor. Disaster or Calamity Relief Section 170 Print Mail Form.

County of Santa Clara. Kern November 30 Santa Cruz November 30 Kings. Acknowledging the unfairness of a taxpayer winning a property tax assessment appeal but not receiving a refund of the fee required to file the appeal Supervisor Simitian led the Board in eliminating the fee for filing an appeal altogether.

9 AM - 5 PM. Santa Clara County repeals fee for property assessments. The regular appeals filing period will begin on July 2 2021 in each county and will end either on September 15 or.

A taxpayer who disagrees with the assessed value on the Notification Card may request a review by presenting to the Assessors Office by August 1 of the current assessment. The request for penalty cancellation review process may take 45-90 days. Closed on County Holidays.

February 2020 Residential Property Assessment Appeals 1. TaxProper did a great job answering any questions I had about the process and their service. If you disagree with the Assessors value you can usually appeal that value to your local assessment appeals board or county board of equalization.

Phone Hours are 9 AM - 5 PM Monday - Friday Excluding all Holidays. County Assessment Appeals Filing Period for 2021 Created Date. 555 County Center - 1st Floor.

Describe in detail the reasons for filing this claim and attach all supporting. I had a fantastic experience getting my property tax deal processed through TaxProper. I would recommend them anytime for tax appeal needs.

Last Payment accepted at 445 pm Phone Hours. MondayFriday 900 am400 pm. Welfare Exemption Claim Form BOE-267.

A payment drop slot is located on the southeast corner of the building near the entrance adjacent to the parking lot. Appeal of Administrative of Architectural Committee or Planning Commission Decisions Form PDF Last Updated. Or Assessment Number for Unsecured Property.

Sandie Arnott San Mateo County Tax Collector. MondayFriday 800 am 500 pm. Send us a question or make a comment.

You will receive an appeal application number and have the option to print your application for your records. Learn more about SCC DTAC Property Tax Payment App. Santa Clara County California.

Make Tax Checks Payable to. Property Tax Department Subject. Agricultural Preserve Williamson Act Questionnaire.

Job in Santa Clara - Santa Clara County - CA California - USA 95051. Karthik saved 38595 on his property taxes. You can complete and submit your Assessment Appeal Application form online by selecting the Appeal Online button below and add PDF attachments.

Penalty Amount APN for Secured Property. See reviews photos directions phone numbers and more for County Property Tax Appeal locations in Santa Clara CA. The article denotes recent increases in value and projected increases in the immediate future citing recent developments in the early stages of COVID-19.

In Santa Clara County a Notification of Assessed Value indicating the taxable value of each property is mailed via postcard at the end of June to all property owners. Santa Clara County Tax Appeal. January 2022 At the end of December 2021 Santa Clara County Assessors office officials commented on the state of property valuation in light of the impact COVID-19 has had on real estate in the area.

Property Taxes Department Of Tax And Collections County Of Santa Clara

San Francisco Property Tax Consultants Ke Andrews Since 1978

Secured Property Taxes Treasurer Tax Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

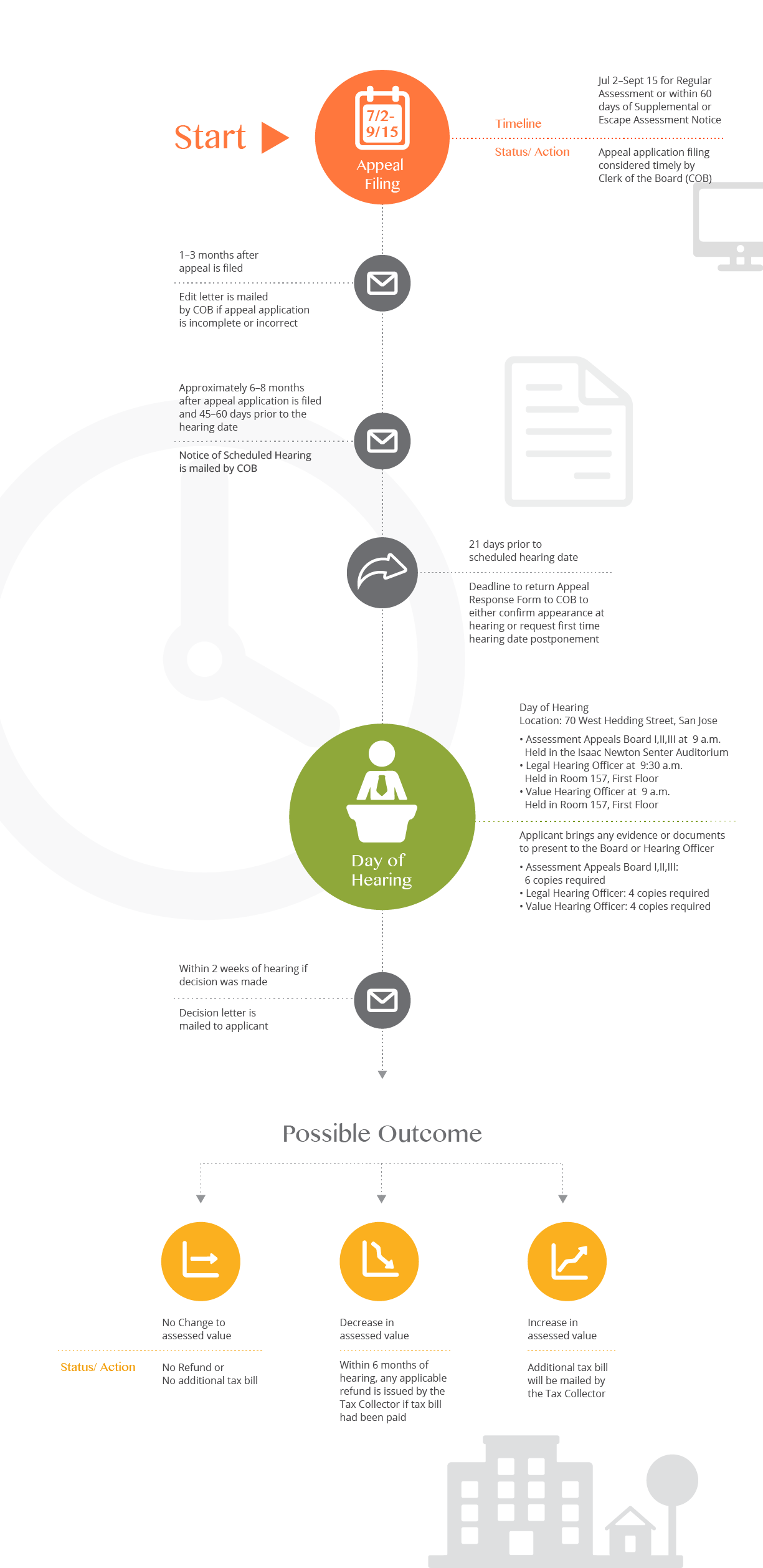

Assessment Appeal Process Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Secured Property Taxes Tax Collector

California Public Records Public Records California Public

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Tech Companies Buoy Property Assessments Appeals In Santa Clara County San Jose Spotlight

Circle Driveway One Floor House House House Styles Story House

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Bay Area Real Estate Recovery Creates Property Tax Appeal Opportunities

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Property Values Subject To Decreases Via Appeal Despite Mid Pandemic Inflation Invoke Tax Partners

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Eagle Roofing 3603 Capistrano Sanborn Blend 3 Tile Rolled Mediterranean Style Home Exterior Color Schemes Mediterranean Style

Arlott 41 5 Wide Rolling Kitchen Cart Slatted Shelves Signature Design By Ashley White Paneling